By Christine Book, Managing Editor

The latest North American Equipment Dealer Assn. (NAEDA) Dealer-Manufacturer Relations Survey results have been tallied, and for the first time, Farm Innovations readers have a chance to take a deep dive into what dealers value most in their manufacturer relationships. The report provides insight, as dealers see it, as to who’s doing the best, who has shown improvement, and which shortline manufacturers take the dubious achievement of loss leader.

The report summarizes the outcomes which reflect dealer expectations and how well those were met by shortline manufacturers, presenting detailed data and a useful look into what matters most and who’s meeting dealer needs, and as a result customer needs as well. Made available to all NAEDA dealer members and participating manufacturers, Farm Innovations is providing this summary report to keep producers in the know with what has come to be considered a valuable annual report card.

Who’s Leading the Pack in OPE?

Looking closely at the dealer rankings of OPE manufacturers, the average overall satisfaction rating in 2024 was 5.51 compared to 5.34 in the 2023 survey. Top 5 leaders among OPE manufacturers were as follows:

- Grasshopper (6.2)

- Wright Manufacturing (6.19)

- Shindaiwa (6.07)

- Scag (5.93)

- Kawasaki (5.92)

Staying on top, the highest scoring mean average by an OPE across all categories was Grasshopper (6.08), followed by: Wright Manufacturing (5.99), Exmark (5.87), Shindaiwa (5.86), and Scag (5.81) rounding out the top 5 leaders. The rankings covered parts and product availability and quality, product technical support, return privileges, warranty procedures and payments, communications with management, as well as marketing and advertising support, and manufacturer response to dealer needs and concerns. Those improving the most on Overall Satisfaction compared to 2023 were Ferris (9.38%), Briggs & Stratton (8.32%) and Walker (5.38%). Notably, Ferris also improved 49.35% from last year in Product Availability, and in that category, Walker saw a 38.93% improved rating.

About the Survey

The 2024 NAEDA Dealer-Manufacturer Relations Survey covers 11 categories, ranging from product availability and quality to warranty procedures, as well as communication with management and marketing/advertising support. While every segment is important and results in those categories can be enlightening, for the purposes of this report to Farm Innovations readers this overview will focus on what’s most valuable to farmers. To that end, the results here include which shortline manufacturers were ranked the highest in these 6 key areas:

- Overall Satisfaction

- Product Quality

- Product Availability

- Parts Quality

- Parts Availability

- Administrative Programs & Protocols

In sharing a comprehensive review of results for Farm Equipment, Editor/Publisher Mike Lessiter noted the importance of the outcomes across all corners of the industry, from top executives to individual dealer network managers and individual shops. Lessiter writes, “One manufacturer executive noted that he and his team anxiously await the survey results each year to gauge performance with their first customer — the dealer. In many ways, the results are akin to a 'seal of approval' and an indication of what a dealer might expect upon choosing any given OEM in a decision to add or keep a line.” Notably, it was reported that dealers have used it as a point of reference on prospective lines, or in rationalization decisions that follow mergers and acquisitions, as well as in the occasional discussion during dealer advisory board meetings. While NAEDA does not break out results by segment (tillage, planting, etc.), dealers — and producers alike — can examine the manufacturers in those categories when comparing suppliers.

Core to Grasshopper Success: Consistency

For the past 10 years, including 2024, Grasshopper has consistently appeared among the Top 5 list of OPE manufacturers in the annual NAEDA Dealer-Manufacturer Relations Survey. This points to a key aspect of our company's ethos: consistency. The past several years has seen a number of mergers, acquisitions and leadership changes in the OPE industry; many which brought uncertainty for OPE dealers. But for 67 years, Grasshopper continues to be family owned and operated. We continue to build our mowers to last years decades and generations — which is evidenced by our top marks in the products- and parts-related categories in the 2024 results.

We take the same approach to building relationships with our dealers as we do to building our mowers: we’re in it for the long haul. Overall, the consistency we provide in company stability, product quality, product longevity, product dependability, customer satisfaction, etc., matters a great deal to our dealers.

— Michael Simmon, The Grasshopper Co., Moundridge, Kan.

Leaders & Losers

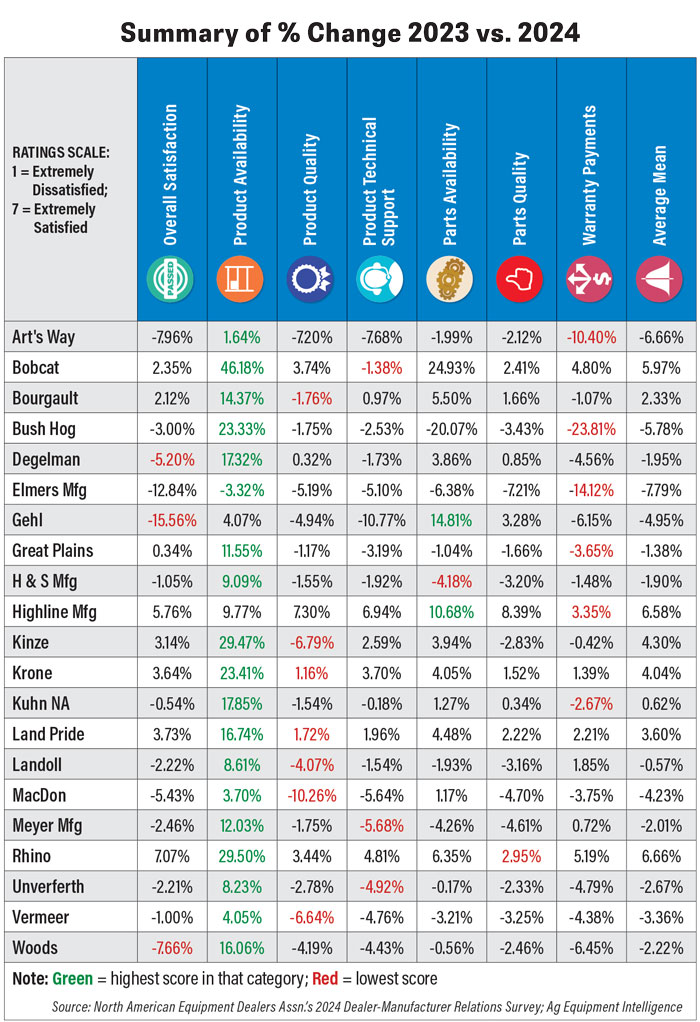

What matters most to dealers? Product quality and parts availability continued to be the top two most important categories, as they were in the 2023 survey. The following are the manufacturers’ performance in 6 key areas. The numerical scores are based on a scale of 1 (extremely dissatisfied) to 7 (extremely satisfied), while the trending data is expressed in percentage change.

Who’s topping the charts? Bourgault clearly takes the leader spot, ranking first in 4 categories: Overall satisfaction, product availability, parts quality and parts availability, coming in 3rd in product quality. Bourgault Industries Ltd. is a global manufacturer of seeding and tillage equipment, headquartered in St. Brieux, Sask. Last year, the company had a strong showing, as well. Meyer and Degelman also repeatedly ranked in the top 5 in multiple categories, as did Highline and Vermeer.

Dealers ranked Gehl the lowest in 2024 in every single category. Ranking low in overall satisfaction were Bobcat, Art’s Way, Kinze and Woods, and MacDon and Art’s Way also showed up with the lowest scores across multiple categories.

Overall Satisfaction

Highest:

- Bourgault (6.27)

- Vermeer (5.97)

- Meyer (5.95)

- Highline (5.88)

- Great Plains (5.85)

Lowest:

- Gehl (2.55)

- Bobcat (4.35)

- Art’s Way (4.74)

- Kinze (4.92)

- Woods (4.94)

Product Quality

Highest:

- Degelman (6.19)

- Meyer (6.17)

- Bourgault (6.14)

- Krone (6.13)

- Unverferth (5.94)

Lowest:

- Gehl (4.43)

- Art’s Way (4.64)

- Bobcat (4.71)

- MacDon (5.16)

- Kinze (5.22)

Product Availability

Highest:

- Bourgault (6.05)

- Degelman (5.96)

- Highline (5.73)

- Meyer (5.68)

- Vermeer (5.65)

Lowest:

- Gehl (1.79)

- MacDon (3.92)

- Bobcat (4.78)

- Kuhn NA (4.82

- Kinze (4.92)

Parts Quality

Highest:

- Bourgault (6.14)

- Meyer (6.0)

- Land Pride (5.99)

- Degelman (5.96)

- Vermeer (5.95)

Lowest:

- Gehl (5.04)

- Art’s Way (5.07)

- Bobcat (5.09)

- MacDon (5.47)

- Kinze (5.49)

Parts Availability

Highest:

- Bourgault (5.95)

- Degelman (5.92)

- Meyer (5.85)

- Land Pride (5.83)

- Unverferth (5.82)

Lowest:

- Gehl (4.42)

- Bush Hog (4.46)

- Bobcat (4.66)

- Art’s Way (4.93)

- MacDon (5.18)

New Analysis of 2024 Data

Ag Equipment Intelligence, a sister publication to Farm Innovations and Farm Equipment, provided additional analyses this year to simplify the results. As such, it consolidated the 12 individual categories into 3 broader areas: product/parts availability, product/parts quality and administrative programs/protocols.

Who’s made the most progress? Reviewing the newly-grouped Product and Parts Availability category, Bobcat made the strongest improvement with a 34.86% improved ranking. Bobcat also had the greatest year over year (YOY) increase from 2023 in the Product and Parts Quality category. The loss leader in both of those categories was Elmer’s, which decreased by -4.88% and -4.04% respectively.

Focusing on the Administrative Programs and Protocols area, Highline Manufacturing showed a YOY increase of +5.11%. On the down side, H&S Manufacturing had a whopping -34.47% decrease in this category from last year.

Survey Methodology

According to the North American Equipment Dealer Assn. (NAEDA), the 2024 Dealer-Manufacturer Relations Survey was distributed to dealership contacts in late March 2024 and remained active until May 24, 2024. Multiple reminders were sent to all who had not yet completed the survey. Each survey link was unique to the recipient, which prevented the survey from being taken more than once. To assist in distribution, several manufacturer brands provided lists of their U.S. and Canadian dealer networks. Duplicate email addresses were removed via a multi-step process. In total, 61 manufacturers were rated in 12 categories.

Dealer responses were collected anonymously by a third-party research platform. Dealer responses were received from 49 U.S. states, Puerto Rico and 10 Canadian provinces. Each respondent rated an average of 4 manufacturers. Of the respondents, 80% identified themselves as owners (51%), general managers (15%) and dealer-principals (14%).